Contents

- Second-order Partial Derivatives

- Canada will see weakest level of homes sales since 2001 this year: TD report

- What is FX hedging, and why should I hedge foreign exchange risk?

- Frequently asked questions about managing foreign exchange risk

- Subsection 4.8.1 Derivatives of Inverse Trigonometric Functions

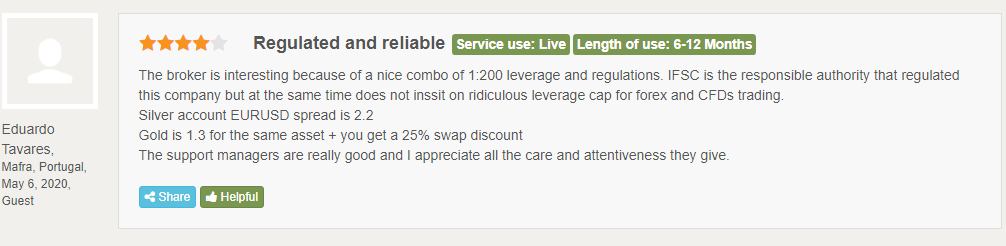

- Leverage

Since you expect the contract price to rise, you would purchase CDU7 futures contract and take a long position in anticipation of that potential rise. What do a Canadian NHL® team, a baked goods exporter and a parts manufacturer have in common? While they operate in very different sectors – selling their products, buying supplies, or competing for ‘the Cup’ across borders – each of them is buffeted by shifting currency rates that can hurt their bottom line. A straightforward extension of the derivatives defined above is that of partial derivatives for functions of several independent variables. Partial derivatives have numerous applications, as for example in physics and engineering; wave equations are among such important examples of the use of partial derivatives in physics and engineering.

In active trading, leverage affords the trader purchasing power via borrowed equity. This is done by posting a good-faith deposit with the broker known as margin. Derivatives products offer participants a multitude of leverage okcoin review options, ranging from minimal to extreme. Let’s assume you predicted accurately and expected a`hike in interest rates.You would subsequently then also expect a spike in the future contract prices after the announcement.

The relationship between Friedberg Direct and FXCM was formed with the purpose to allow Canadian residents access to FXCM’s suite of products, while maintaining their accounts with a regulated Canadian firm. All accounts are opened by and held with Friedberg Direct, a division of Friedberg Mercantile Group Ltd., a member of the Investment Industry Regulatory Organization of Canada . Friedberg customer accounts are protected by the Canadian Investor Protection Fund within specified limits. A brochure describing the nature and limits of coverage is available upon request or at To active traders, volatility is viewed as being a positive market attribute.

A function is not differentiable at a if its graph has a vertical tangent line at a. The tangent line to the curve becomes steeper as x approaches a until it becomes a vertical line. Since the slope of a vertical line is undefined, xtb review the function is not differentiable in this case. A function is not differentiable at a if there is any type of discontinuity at a. The graph of the profit function \(P\) in thousands of dollars is shown below.

This increase in cost may be the result of several factors, among them excessive costs incurred because of higher maintenance, overtime to keep up with demand, production breakdown due to greater stress and strain on the equipment, and so on. Below, the graph of the total cost function is shown with \(C\) measured in thousands of dollars. In the following examples we will derive the formulae for the derivative of the inverse sine, inverse cosine and inverse tangent. The other three inverse trigonometric functions have been left as exercises at the end of this section.

Second-order Partial Derivatives

It’s important to remember that derivatives are leveraged instruments based on the price of the underlying asset; due to this leverage, a derivative’s price movement can be swift and dramatic. Before trading any derivative financial contracts, a participant is well-advised to monitor the market depth and relative liquidity of the target product. Generally, products with strong market depth offer tight bid/ask spreads and reduced slippage; products with sparse liquidity feature enhanced slippage and wide bid/ask spreads. Protect your profit margins by locking in exchange rates without tying up your working capital. Be ready to take on more opportunities and grow your business with EDC’s FXG.

Forex trading is challenging and can present adverse conditions, but it also offers traders access to a large, liquid market with opportunities for gains. Trade popular currency pairs and CFDs with Enhanced Execution and no restrictions on stop and limit orders. So while it might have been beneficial pursue a long position on the contract for an extended period of time,it is advisable to only do so when additional or a change in current catalysts have been identified. What is even more interesting to see is that just 4 days later on 17th July, CDU7 contract price actually went up by 1.03% from the 13th. Environment and Climate Change Canada says Teck Metals, a subsidiary of Teck Resources, has been ordered to pay $2.2 million in federal and provincial fines for an effluent spill into the Columbia River. Plans to launch a new route to fly travellers from Canada to Europe by this summer.

Canada will see weakest level of homes sales since 2001 this year: TD report

Popular contracts are based on the euro, Japanese yen, Swiss franc, British pound and Canadian dollar. Transactions on the exchange are regulated and guaranteed, mitigating counterparty risk. Currency futures contracts are traded in standard sizes and have set maturity dates, generally falling on the third Wednesday of March, June, September and December. Participants in currency futures contracts can be “hedgers” seeking to lock in a price to diminish the risk of a future price change, or they can be “speculators” who enter into a trade seeking potential gains. A derivative includes a broad range of contracts or instruments, including options, swaps, futures contracts, forward contracts or other financial or commodity contracts or instruments whose value is based on an underlying interest.

Individuals trade derivatives to achieve a range of financial objectives or goals. For speculators, many derivative products offer the volatility, liquidity and leverage ideal for a multitude of trading strategies. Scalpers, day traders and swing traders frequently target forex and futures products for this reason. Although not a universal fact, most derivatives markets feature robust liquidity.

Subledger granular reporting allows for justification and auditing of unrealized profit or loss balances. In addition, unsettled foreign currency receivables and payables that are forward trades are mark-to-market inclusive of remaining forward points inline with FX derivative accounting best practices. Datasoft FxOffice automates profit or loss recognition from foreign exchange trading and settlements including valuation of FX forward derivatives and currency position exposures. The average rate of change is equal to the slope of the secant line that passes through the points (f, f) and (a, f). As x approaches a along the curve, the secant line approaches the tangent line to the curve at a. The slope of the tangent line at a is equal to the instantaneous rate of change of the function at a.

What is FX hedging, and why should I hedge foreign exchange risk?

The Bank of Canada on the 12th of july raised interest rates by 25 basis points to 0.75%. While any change in a country’s monetary policy can cause FX futures values to fluctuate, an interest rate hike for the first time in 7 years is sure to cause an uproar. Despite this reality, and the fact that so many Canadian companies do business across borders, only half of companies with currency exposure have a defined hedging strategy.

- Unfortunately the notion of the “slope of the tangent” does not directly generalize to more abstract situations.

- In addition to use as a means to buy or sell currency, options can also be used to buy or sell other derivatives such as futures.

- On the other hand, hedgers buy and sell derivatives to manage risk.

- The special value of derivatives contracts compared to contracts for direct trade of underlying assets is that they allow transference of risks from individuals or entities less willing or able to manage them to those more willing or able to manage them.

Foreign exchange risk management is how you can get protection against exchange rate fluctuations. Market depth can be a challenge to quantify in the OTC derivatives markets. In an OTC setting such as the forex marketplace, reported trading volumes originate from liquidity providers or brokerage services.

Frequently asked questions about managing foreign exchange risk

The cost of not hedging even partial FX exposure could outweigh the cost of the FX hedging product chosen for your situation. Hedging guidelines are based on company needs and may involve a cost to secure a specific rate using a specific currency derivative. It is a good idea to work with your FX provider to mitigate costs and have a forward looking perspective. Protecting against exchange rate fluctuations is more important than ever, as changing currency rates, supply chain disruptions and market instability have become constants in today’s business climate. Options are traded on both the over-the-counter market and also on exchanges.

Although similar in objective, trading and investing are unique disciplines. Duration, frequency and mechanics are key differences separating the approaches. Trading Station, MetaTrader 4, NinjaTrader and ZuluTrader are four of the forex industry leaders in market connectivity. Regularly features a market itrader review depth vastly greater than that of other major, minor, or cross pairs. The more robust trading volumes, the greater the market depth and aggregate liquidity. The relationship between Friedberg Direct and FXCM was formed with the purpose to allow Canadian residents access to FXCM’s suite of products.

Often one party to the agreement will seek a fixed-rate interest payment at a steady yield while the other party seeks a floating-rate payment that could offer an opportunity for an improving yield. A currency swap is an agreement between two parties to exchange flows of payments in two different currencies on different dates. Participants in currency swap agreements typically seek to exchange the terms of interest repayments available to the respective counter-parties to the agreement.