In a few situations, you could qualify for another type of financial a couple of years once a property foreclosure. But you might have to waiting offered.

The majority of people that undergone a foreclosures ponder if might previously be able to get a house once more. Credit agencies can get statement foreclosure on the credit reports getting 7 many years following earliest missed commission you to definitely triggered the fresh property foreclosure, prolonged when you are seeking to that loan getting $150,000 or even more.

But sometimes, it could take below eight decades locate a special home loan after a foreclosures. Enough time you have to hold off before getting a beneficial new home loan relies on the type of loan and your monetary items.

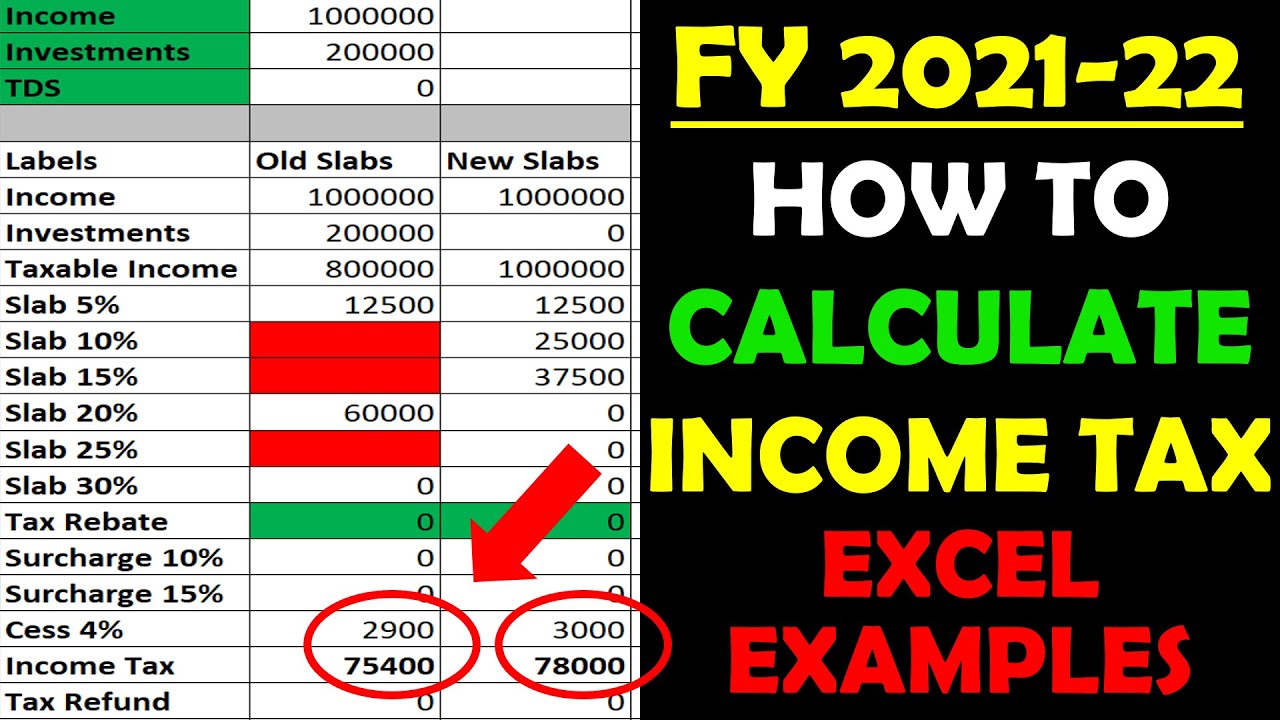

This new graph less than reveals how much time the fresh new waiting period are immediately following a foreclosures for various categories of financing, with details less than.

And additionally, a property foreclosure can cause a critical decline in your credit ratings, therefore it is more challenging discover another type of financial. Just how much your own ratings will slip relies on the potency of your borrowing from the bank in advance of losing your home. Should you have excellent borrowing from the bank before a foreclosure, which is rare, their results is certainly going off over if you’d currently got late or missed repayments, charged-out of membership, and other bad items in your credit history.

If you can purchase a loan, even after this new waiting period ends, hinges on how well you’ve rebuilt your own borrowing following the foreclosures.

Waiting Several months to have Fannie mae and you can Freddie Mac computer Financing Just after Foreclosure

Specific mortgages comply with direction your Federal Federal Mortgage Relationship ( Fannie mae ) together with Government Financial Home loan Corporation ( Freddie Mac ) set. This type of fund, named “conventional, conforming” loans, qualify to appear so you can Federal national mortgage association otherwise Freddie Mac.

Ahead of , the brand new wishing period having yet another financing adopting the a foreclosures are 5 years. Now, to qualify for financing significantly less than Fannie mae or Freddie Mac guidance, you ought to constantly waiting at least seven decades immediately after a property foreclosure.

Three-Seasons Waiting Months To have Extenuating Factors

You will be in a position to reduce new waiting period to 3 decades, counted throughout the completion big date of your property foreclosure action, to possess a fannie mae otherwise Freddie Mac financing if extenuating factors (which is, a posture that was nonrecurring, beyond your manage and you may resulted in a-sudden, significant, and you will offered reduction in earnings or a devastating rise in financial obligations) was the cause of foreclosure.

- show that foreclosure is actually caused by extenuating issues, eg divorce proceedings, disease, sudden loss of household income, otherwise work loss

- getting Fannie mae, have a max loan-to-value (LTV) ratio of the new financial away from either 90% or even the LTV ratio listed in Fannie Mae’s loan places Slocomb qualifications matrix, whatever is better

- to own Freddie Mac, has a max loan-to-worth (LTV)/complete LTV (TLTV)/Home Guarantee Credit line TLTV (HTLTV) proportion of your lower of ninety% or perhaps the restriction LTV/TLTV/HTLTV proportion toward deal, and you will

- make use of the the latest real estate loan to invest in a principal home. (You cannot make use of the loan to get an extra home otherwise money spent.)

Wishing Months getting FHA-Insured Finance Just after Property foreclosure

In order to be eligible for a loan that the Government Casing Management (FHA) ensures, your generally need certainly to waiting at the least 36 months shortly after a property foreclosure. The 3-season time clock initiate ticking if the foreclosures circumstances has ended, usually on day the residence’s identity transported as a beneficial results of brand new property foreclosure.

If the foreclosures also inside an enthusiastic FHA-insured loan, the three-season prepared months begins whenever FHA paid back the previous financial on the the claim. (If you dump your residence to help you a foreclosure nevertheless the foreclosure selling rate doesn’t fully repay an FHA-covered financing, the lending company makes a state they the fresh new FHA, and also the FHA makes up the lender into the loss.)