Using a business loan for rental possessions can help you develop a bona fide estate profile by giving fund to invest in unmarried otherwise several local rental attributes and supply currency to have home improvements and you can updates to help you boost local rental earnings.

Discover a wide variety of financing alternatives for individuals, however, looking a business loan for rental possessions will often end up being particularly running into a solid wall. Except if, obviously, you are aware where to search!

We are going to talk about the various organization financing options available for rental possessions and you may mention how Small company Government (SBA) funds are used for real estate investment.

- A business mortgage the real deal property is actually a substitute for acquiring financing having a personal verify.

- Of several lenders place a whole lot more emphasis on business possessions and the local rental possessions utilized as the guarantee when underwriting a corporate loan.

- Source for rent assets loans were banking institutions that a beneficial business is currently doing business and personal and you may profile loan providers.

- A couple of mortgage apps supplied by the fresh SBA to greatly help a corporate buy a house for the individual fool around with is actually SBA 504 and you can SBA 7(a).

1 home. Conventional loans

When shopping for a corporate financing having a residential property, the initial stop is the financial or borrowing relationship that you might be already working. The chances try the branch director and several of one’s staff already know just you by-name and can even acceptance the possibility to earn much more of business.

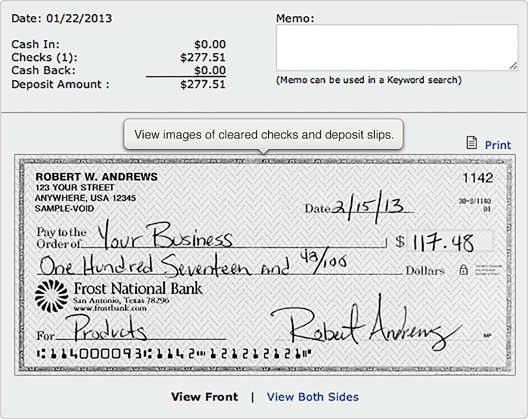

- Credit history indicating a track record of paying back loans promptly

- Lender statements to help you file earnings and forecast future business cash flow

- Organization taxation statements exhibiting the fresh new historic show of providers since claimed on the Irs (IRS)

- Profit and loss declaration providing a loan provider which have money and you can debts details more numerous attacks

- Balance layer revealing current property and you may debts demonstrating exacltly what the team has and you will owes, and additionally owner’s security

- Business strategy and economic projections discussing what the financing might be utilized for, including purchasing leasing property, and money-disperse forecast exhibiting that mortgage can be paid off

A lender can also ask for comparable personal data and request an individual be certain that out-of team principals, no matter if your enterprise is obtaining financing.

2. Team term financing

Old-fashioned banking institutions, borrowing unions, and private lenders bring providers name finance. There are many different identity financing solutions with various financing brands and you can interest levels. Name financing for companies render fund purchasing products, posting a workplace, and purchase a residential property. Funds is actually acquired in one lump sum and you will paid off more than an occasion, typically that have a predetermined interest rate.

Short-identity loans, also known once the link finance, often have a cost term of one year otherwise faster and tends to be a good option for purchasing accommodations assets rapidly prior to looking to a vintage bank loan. Medium-name loans routinely have terms ranging from 1 in order to 5 many years, whenever you are a lot of time-label business loans have regards to up to twenty five years.

step three. Team line of credit

A business personal line of credit is a lot like a property security credit line (HELOC), apart from the mortgage is actually for a business. A company can also be draw with the personal line of credit as needed and pay only attention towards amount of loans borrowed. The financing line try rejuvenated because the loan are paid, and you can money are around for acquire once again.

Lines of credit could be protected by the assets the company owns or unsecured without security support the mortgage. Rates and fees are generally down that have a secured providers credit line. But not, in the event your financing is not paid back, the financial institution takes the newest equity regularly hold the financing.