- Title and make contact with information on the latest present donor

- The connection between the debtor in addition to gift receiver

- The reason for new provide

- How much cash being skilled

- This new address of the property are bought

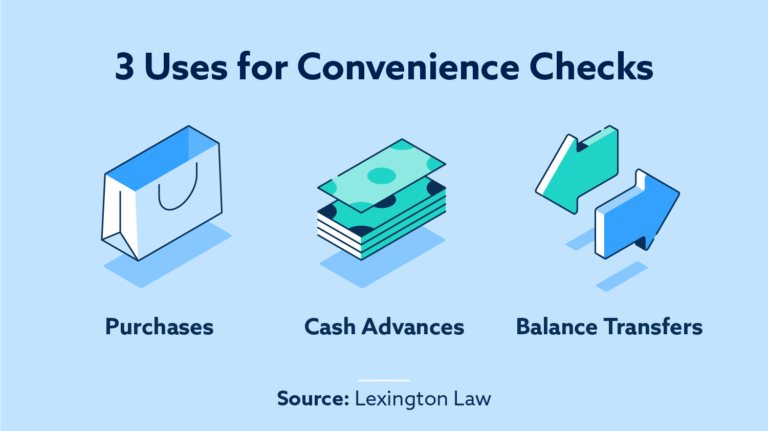

FHA Recommendations to own Gift Financing

Getting a borrower in order to fool around with current money, new FHA gift fund assistance need to be met. Because of this brand new current fund need are from good offer which may be recorded, also providing a gift letter.

Overall, the FHA isn’t really concerned with in which the donor’s funds are from. Also borrowing from the bank money are acceptable as long as it will not require person acquiring the new present to settle the loan. The money and cannot be given considering the marketing by any means. The brand new donator can use money from deals accounts, and income out-of financial investments particularly carries and you will securities.

Loan providers like to see consistent and you may regular cash flow typing their family savings after they underwrite the mortgage. not, a present to help with their downpayment and settlement costs may be out of the ordinary and will getting a sign of trouble. Thus, the financial institution need more info concerning gift finance.

The financial institution may wish to select documents that demonstrate the money being directed from a single membership to another. This will mean a statement from the provide donor’s membership and you to definitely on the debtor demonstrating the fresh import. This may and additionally mean a copy of the cashier’s evaluate and you can receipt regarding bank, and you can printouts appearing this new balance both before and after this happens.

If brings or securities can be bought to own gift financing, comparable documents will be required. A definite paper trail makes it easier on the underwriter to show the main cause of your financing.

Finding FHA Gift Money

When current money is obtained, the new borrower is put that money merely after they took a printout of their membership with the newest balance. Then when the bucks is actually its membership, they need an alternate printout on brand new harmony.

Whether your debtor obtains several gift, they’re going to have to do the same thing with each and you can not put them to one another.

Present Income tax Maximum

The latest provide donor should also understand number of present income tax restriction. So it restriction is actually $18,000 to have a single person inside the 2024 and you can $36,000 getting married people. This is certainly a yearly allocation you to enables you to stop submitting an excellent current taxation get back.

Even if you meet or exceed so it count and possess so you can document an effective gift income tax go back (Internal revenue service Form 709), it probably means you still won’t shell out extra tax. Government current tax simply must be reduced for many who exceed the new existence house taxation difference, that’s currently $ mil and double to have married people.

Gifts of Guarantee

There’s another way to assist a family member buy an excellent family that doesn’t include donating money. When the a dad really wants to sell their residence on the mature child at a discount, the fresh new FHA allows them to provide equity throughout the assets.

If the residence is worthy of $350,000, a dad you may sell it on their youngster to possess $250,000, going for $100,000 off guarantee. This new debtor you will after that use this collateral as a deposit to assist them to along with their financing recognition.

The new FHA does have certain restrictions in the who’ll contribute site web link currency to assist a borrower. Currency are going to be skilled throughout the after the anyone:

- The newest borrower’s members of the family

- A close friend that have a recorded need for the life off the fresh new borrower