New Agency off Groups (Communities) work together with the personal, regulators and not-for-cash groups to provide construction alternatives and you will direction all over Perth and you may in local and you will secluded WA.

Common home ownership

When you are sick of renting, or unable to cut in initial deposit, the newest common home ownership initiative is one way you happen to be capable afford to buy your own home.

Shared home ownership enables you to show the purchase away from a great house or apartment with the new Department off Groups as a result of a contributed Owning a home Mortgage that have Keystart, the official Government’s home loan lender.

Keystart reasonable-deposit mortgage brokers

Keystart will bring full ownership and common ownership home loans. Specific home loan help is including readily available for best parents looking to to hold the household household, people living with a disability you to definitely affects homes demands, and you will Aboriginal people.

For additional info on Keystart’s financing services qualifications criteria, contact Keystart towards the 1300 578 278 or visit the Keystart webpages.

People will have an offer as high as $step three,000 to have stamp obligation and you will payment charges. Is always to such will cost you feel less than $step three,000, they’ll be fully paid for of the Communities just in case it are more, the fresh new buyer will spend the money for matter over $3,000.

Purchasers gets a benefit needless to say recognized capital improvements they have made towards possessions. Friends can assist on the buy regardless of whether they very own their property or perhaps not.

- At least age of 3 years continued tenancy that have Teams.

- No need for one large amount of domestic residential property (enhanced otherwise unimproved).

- No most recent arrears or any other expense so you can Communities (including drinking water practices costs) in the course of software and you will settlement.

Organizations have a tendency to take into account the revenue out-of a house so you can qualified renters into the perspective of the most recent concerns and you will planning.

Move into pick solution If your current property is not available buying, you are considering another property getting a person is available and you will you’ve chosen the newest transfer to purchase’ choice on your own application.

A home is only going to become marketed if this features its own term during the time of application, otherwise a good subdivision is possible and you can funding is present to subdivide mother or father headings.

While you are wanting buying your local rental property, might earliest need certainly to see fund pre-approval thanks to a bank, strengthening society, borrowing from the bank commitment otherwise Keystart.

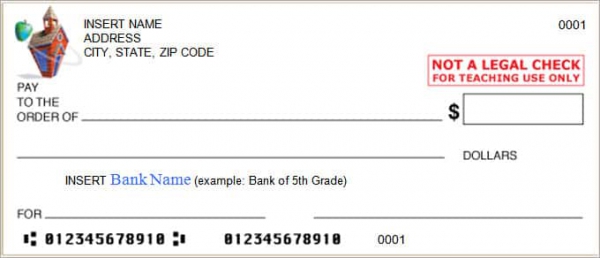

After you have obtained fund pre-approval then you can complete the form and you will send they along with your deposit of $150 (thru a beneficial cheque or currency order made payable so you can Agencies regarding Groups – Housing) to:

In case the house is unavailable obtainable and you’ve got perhaps not selected the fresh move into buy alternative, the job will be withdrawn, along with your deposit would-be gone back to your. Please be aware one Communities’ decision within matter are last and you can there isn’t any attention processes.

When you yourself have chosen this new move into get choice, Teams will attempt to track down an alternate possessions to you personally in your spending budget. This course of action takes to three months. If a unique house is offered, you may be informed consequently. When the not any other house is offered within 3 months, the job will be withdrawn as well as your put might possibly be returned to you personally.

When a house can be found offered, its market value would be computed. Any investment advancements you made having enhanced industry really worth, for example a home repair, incorporating a patio otherwise carport, or any other points regarding the recognized list is counted. Land, painting and other maintenance goods are perhaps not included. The purchase MN san ramon installment loans price could be the ount greet getting developments.

Communities will then give you a composed give and you will be given 1 month to just accept the deal and gives research away from identity. A contract is then authored up in order to program the latest money approval to suit your financing.

Take note that should you not undertake Communities’ bring and you will wish to to help you withdraw the application, your put of $150 try non-refundable and additionally be retained of the Organizations. The explanation for this might be to help with recovering the expenses incurred by the Communities toward valuation charge.