Score any paperwork manageable so you’re able to automate the procedure before applying for a financial loan. Let’s go over this new files you’ll constantly you need when you implement getting a home loan.

Evidence of Money

Their bank often request you to promote a few files to ensure your revenue. Specific data you may want to add include:

- At the least 24 months from federal tax models

- Their a few current W-2s and spend stubs

- 1099 forms otherwise profit and loss statements while you are care about-functioning, or any other even more files

- Divorce proceedings decrees, youngster assistance conclusion and just about every other courtroom documentation that verifies you to definitely you can easily continue steadily to discover money for at least a special three years, in the event the appropriate

- Court files you to definitely shows you have been finding alimony, youngster support and other style of money for at least 6 months, in the event that appropriate

Borrowing from the bank Papers

Your own lender have a tendency to cost you spoken otherwise composed permission in order to consider your credit score. They are going to look at the credit history and search having situations (including a bankruptcy or foreclosure) who does disqualify you against bringing a loan. If you do have a personal bankruptcy or foreclosures on your own credit declaration, you’ll have to hold off a few years ahead of you might be eligible for a mortgage.

If you had an enthusiastic extenuating circumstance you to definitely damaged your own borrowing, it is preferable to explain so it towards financial with facts. Such as for instance, for people who overlooked a few money on the credit card bills due to a health emergency, you can even provide your own bank a duplicate of your medical expenses. This proves to your financial that crappy scratches on your own report was in fact caused by a-one-go out such as, in lieu of a pattern.

Proof Property And you can Liabilities

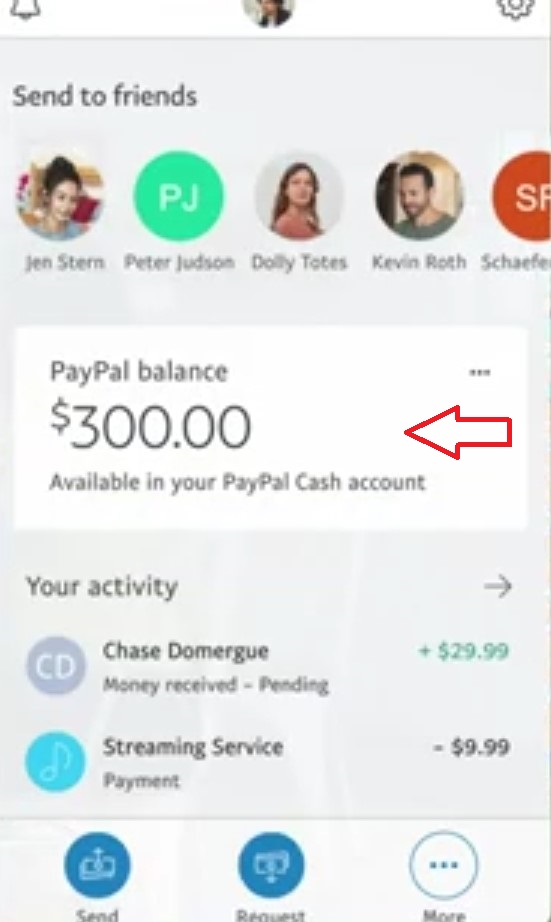

- Doing 60 days’ value of account comments you to confirm the new assets on your checking and you can offers membership

- The most recent statement from your old-age or money account

- Data into profit of every possessions you have got rid of before you used, instance a duplicate of the title import if you sold a motor vehicle

- Research and you may verification of any gift funds placed into the membership over the last 2 months

The financial may ask you for extra details about people expenses your debt, eg a student-based loan or a car loan. Work together with your lender and gives any requested information right as you are able to.

Getting A mortgage With Rocket Financial

After you’ve all your valuable paperwork in order, it’s time to initiate looking that take a look at this website loan. Here’s what you can expect after you get a property mortgage having Skyrocket Financial .

Step 1: Submit an application for Home loan Preapproval

Preapproval is the process of having the ability far a lender was happy to lend to you. Once you apply for an effective preapproval, loan providers have a look at your earnings, possessions and you will borrowing, and you may let you know how much capable provide your. They’re going to along with influence their rate of interest. A beneficial preapproval differs than a good prequalification. Prequalifications is quicker specific than just preapprovals because they do not need advantage confirmation. Make fully sure you get a good preapproval as opposed to an effective prequalification.

Bringing preapproved for a loan is a good idea because it offers an exact thought of just how much you really can afford to pay towards the a property. This will help you slim your residence search, therefore makes you more appealing in order to each other providers and real estate professionals.

The first thing you’ll carry out after you get preapproval try answer some questions relating to oneself, your earnings, their property therefore the house you want to purchase. You may then offer Skyrocket Financial permission when deciding to take a review of your credit history. Your credit report was an eye on their borrowing record away from people lenders and you can creditors you lent from before, and credit card issuers, financial institutions, credit unions and much more.