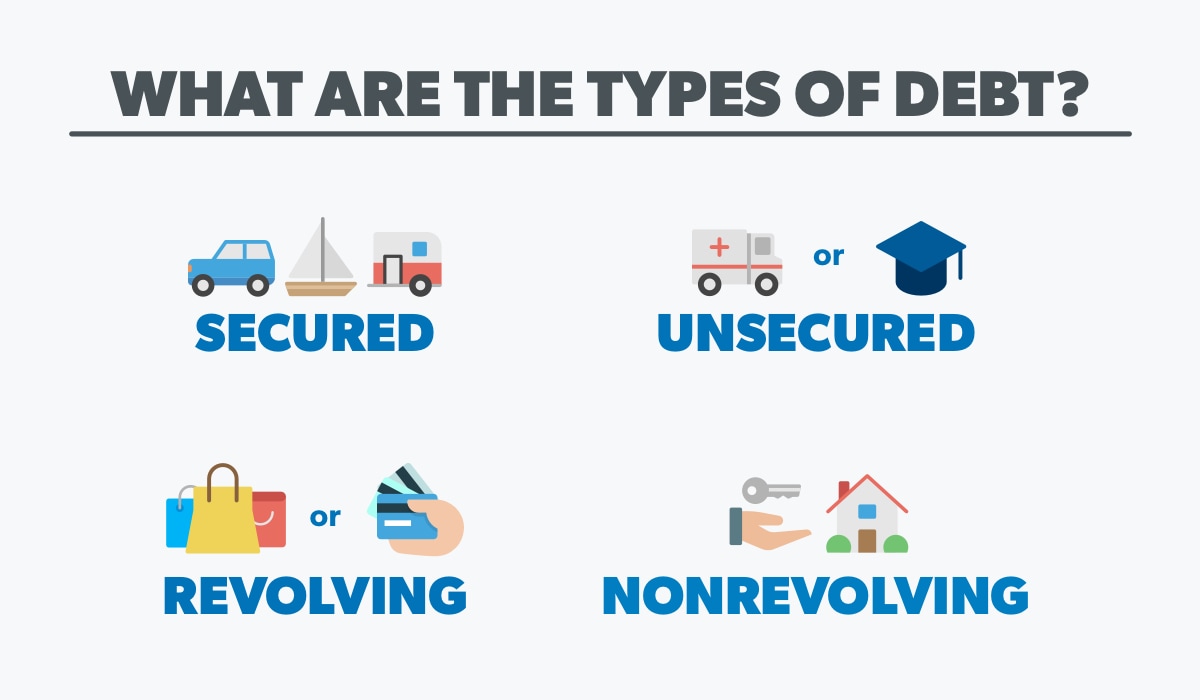

If you find yourself a resident, discover will of numerous expenses you only pay for. As a result, you must deal with various kinds of debt, including your mortgage, figuratively speaking, automotive loans, playing cards or maybe more. For some, this type of monetary commitments renders dealing with your bank account somewhat a challenge. The good news? You need new economic electricity you’ve collected in your home and come up with handling your bank account easier!

Doing a funds-out re-finance doesn’t reduce the amount of loans you owe, however it can present you with money on give to spend down that debt, save you towards the interest and possibly lower your monthly payments. Read on to learn more to see genuine samples of playing with a money-aside refinance so you’re able to combine debt.

Did you know that interest rates with the mortgages are typically far below the individuals getting handmade cards? Such, for the 2018 the fresh You.S. mediocre getting a 30-seasons repaired rate financial try as much as 5%. Nevertheless average bank card rate of interest for similar day try up to 18%.

It may be easier for you to pay off the debt if you are paying a predetermined amount during a period of date

For the majority property owners, it does not sound right in order to maintain balances with the high-interest financing or handmade cards when you yourself have the chance to refinance your residence. Once the home mortgages hold a reduced interest than just borrowing from the bank cards, it can be simpler for you to pay off the debt by paying a predetermined number during a period of date. At the Domestic Family Financing, the loan officers helps you make sense of your and you will particular choice if you find yourself additionally organizing your money.

Unfortuitously, loans is actually a major problem for some American property. It might seem as if there is no respite from higher-attract stability, you could take smart monetary procedures to lessen the burden. Having homeowners, included in this should be to combine one obligations minimizing their monthly bills from the refinancing their ideal monetary advantage your home.

Why would I would like to spend way more once i lack in order to?

There was usually about ten fee factors separating the common 30-seasons financial rates about mediocre bank card interest rate. Simply because credit card debt are perceived as far riskier than just financial obligations, together with credit card companies have a tendency to fees attract correctly. Like, if you have financial obligation that can cost you your 15% therefore circulate they so you can that loan that charges you just 5%, you could effortlessly give payday loan Valley Head yourself almost a great 10% go back on the money. Is reasonable, proper? Ponder why must I want to pay alot more as i don’t have in order to?

So it debt consolidation reduction is accomplished via an earnings-aside re-finance. This allows that turn brand new collateral you’ve collected into the your property on the bucks which you can use to own everything you favor. A familiar choice for homeowners will be to combine credit debt using a cash-aside re-finance because they can create repaired money inside more a set time frame versus investing a rotating harmony for every single month.

Provided an earnings-away re-finance?

You’ll want to make sure you have sufficient guarantee in your the place to find capture out of, and that the bucks you are taking out of your home won’t leave you that have a loan-to-worthy of (LTV) ratio you to definitely is higher than what is allowable. Normally, on Conventional investment, the utmost you could potentially use is 80% of the worth of your house, even if on occasion you could see 85%. Surpassing an enthusiastic 80% LTV ratio means that you’re going to have to purchase private home loan insurance rates, that add to their payment but nevertheless may make experience in comparison to the raised interest levels of your borrowing from the bank notes youre repaying. Refinancing if you find yourself at an 80% LTV often means we are able to remove their financial insurance rates as a whole an alternative advantageous asset of a cash out refinance!