Precisely why you might believe introducing security

Typically the most popular need individuals and couples like to launch equity should be to generate retirement more comfortable. The cash can help you having economic planning for retirement in order to help you retire early, tick one thing away from the container record otherwise pay off a great expenses when you look at the later existence.

Another prominent reason behind unveiling security will be to offer all or some of the money to help you a relative. Nowadays, this is often completed to increase the relative purchase their very own possessions.

What will happen in the event that household rates slide?

The fresh new equity discharge be sure prevents security launch organization away from requesting more money than was elevated from the sales of your house.

If the family pricing slide while the citizen is within negative equity, meaning it owe on the brand new guarantee discharge financing than the property is worth, they do not have to pay anything else than the selling rates.

Anything during the estate, such as coupons, need not be used to pay off the lending company, nor perform some beneficiaries of one’s will have to afford the bank the latest shortfall.

Simply how much can you pay toward equity discharge?

The quantity you pay right back immediately after playing with a guarantee launch plan is determined by for folks who utilized a home reversion system or a lifestyle mortgage.

Which have a property reversion system, the company gets a cost equal to the fresh new express of assets they now very own. Such as for instance, once they own 50% of the home, they will certainly get 50% of one’s money elevated regarding purchases of the house.

Once the zero attract was extra, the quantity due is not difficult. Although not, these lenders could make somewhat reduced proposes to make certain profits actually should your house value provides diminished.

Having a lifestyle mortgage, the amount you have to pay back on your equity launch bundle usually trust around three issues, namely:

- The brand new repaired interest your agreed to

- The full time elapsed between the start of the home loan while you perish or get into much time-title care and attention

- How much cash released

Such as, taking out fully a life home loan regarding ?65,000 on a fixed interest off 6.4% more than several decades create equal a complete personal debt of only lower than other ?137,000. Even though your debt is collect quick, it is vital to understand that you might never are obligated to pay more the worth of the house or property in the event that business of your home is done.

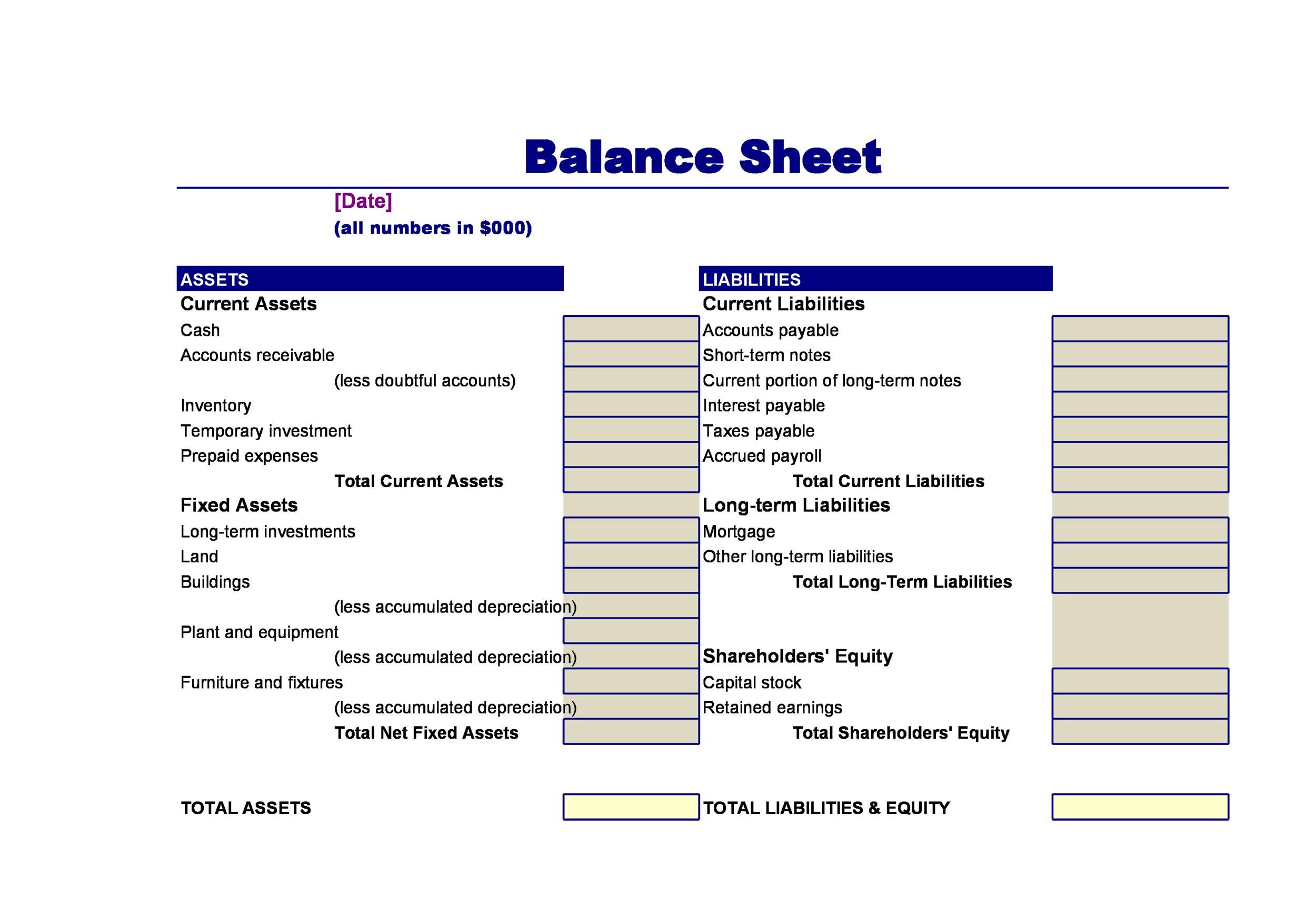

Guarantee Release Comparison

We’ve got make so it desk so you’re able to most readily useful see the differences between a property reversion plan and a lifetime financial.

If you wish to learn more about such guarantee launch types and exactly how they might apply at the children’s heredity, definitely discover all of our detail by detail book.

Do you have to shell out fees?

The cash you obtain out-of security launch isnt susceptible to taxation or Financing Growth Income tax (CGT) dos . Only money obtain from work or income since the a home-operating sole trader is at the mercy of income tax. And Investment Progress Income tax is used on payouts when you sell a secured asset, such as for instance a home.

Without a doubt, the former cannot implement, however, why do your not have to spend CGT on guarantee discharge? The solution is that you haven’t offered your house.

Though it may feel such as for instance offering your house and continuing so you can are now living in it, just what have taken place is you have chosen to take out that loan up against particular or every possessions. Money from fund isnt at the mercy of any British taxation.

There clearly was a possibility one initiating security and you will gifting the bucks in order to some body can lessen genetics taxation (IHT). However, this might be high-risk and could not worth it overall.