The worth of investment is fall in addition to increase, and also you ount you purchase. One tax efficiencies described are those implementing significantly less https://clickcashadvance.com/personal-loans-il/chicago/avant/ than most recent guidelines, which may alter. Qualification criteria, fees and you can fees pertain.

What’s an infant Faith Fund?

Child Believe Financing is overall, tax-totally free savings makes up students that were build from the Bodies inside 2005. Which have an infant Believe Loans is great reports, it indicates you’ve got a financial investment available after you started to 18.

You will have an infant Believe Financing if you were created ranging from very first , if you don’t, your parents otherwise guardians features directed it for the good Junior ISA.

The bucks is actually dedicated to a tax-productive funds on your own title until you turn 18 after you takes power over your investment and pick to continue spending, build a detachment or transfer to a special ISA vendor.

The infant Believe Finance is actually invested in the private Profile Balanced Loans that is treated from the positives within Coutts & Co.

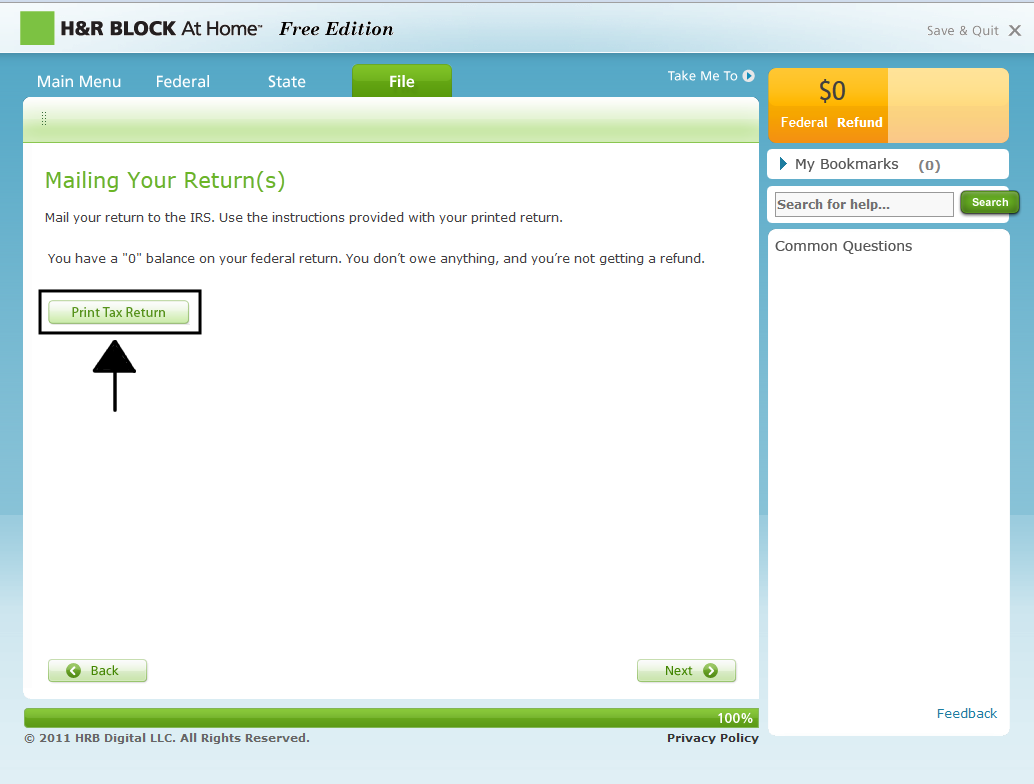

Our on line site allows you to check through to their Youngster Believe Financing, also to accessibility disregard the when you change 18.

The fresh registered get in touch with (the person who provides parental duty to the youngster) can also be check in on the portal any time. The infant can take over duty to your account in the 16 nevertheless they will be unable to access the brand new webpage until he or she is 18.

New inserted get in touch with to have an account can see the latest value of one’s membership, finest it, build a direct debit, or inform us for those who have altered address.

- the term

- go out out of beginning

- client account count (8-hand count starting with step 1 is actually contains in your yearly comments, which is treated on inserted get in touch with).

In which are my Child Trust Financing?

Youngster Believe Loans take place in various British banks. You can find out where your youngster Trust Funds can be found through:

- check in and build a government gateway log in

- your full name and you will address

- little one’s name and you will target

- infant’s national insurance coverage amount otherwise unique resource count in the event that identified.

- child’s complete name and you may target

What are the results whenever my Youngster Faith Fund grows up?

We will develop for your requirements 20 weeks in advance of the birthday celebration that have factual statements about forget the and information on ideas on how to register for the online portal.

On your own eighteenth Birthday we are going to move your investment regarding the Child Trust Money with the a beneficial Grow Youngster Believe Fund, keepin constantly your money committed to the private Collection Healthy Finance until you choose what to do with your currency and provide you to your needed files.

Immediately following registered on the web, you’ll be able and work out an alternative regarding your currency. You might want to keep spending with us from the moving the fresh new capital into the a grown-up ISA, you might withdraw most of the or part of your investment into the an excellent Uk most recent otherwise bank account in your own term, or you can transfer to a special ISA seller.

Any type of option you choose we need to elevates as a result of specific more monitors to ensure your label and you will address. We make an effort to make the necessary suggestions away from you on the internet, however sporadically we must request you to render copies of paperwork on the blog post to assist with this specific techniques.

When you are being unsure of on what identity files you ought to provide, excite consider all of our frequently asked questions less than.

Every records considering on the internet, or perhaps in new post, will be examined from the our team. Take note that in the event that you always withdraw from your own financing, this type of monitors will need to be over ahead of we launch commission into the checking account and this takes doing an effective few weeks sometimes.

If you choose to keep your currency spent, this is exactly gone regarding the mature Youngster Believe Finance towards a grownup ISA within 24 hours following the acknowledgment of your own instruction.

What account can i accessibility my personal currency?

You’ll want to possess a great Uk most recent or bank account in your own identity if you build a withdrawal, so make sure you have that solved ahead.

We can just take guidelines about membership holder after you turn 18 and you may have to establish the name once you inform us what you would like to create along with your money.

You can desire consistently dedicate around in the an enthusiastic Mature ISA, withdraw all of the or section of your finances, otherwise transfer to another type of ISA provider.

Take note it may take around a few weeks in the some instances from receipt regarding appropriate identification and withdrawal classes for the newest percentage is made into your bank account.

If not actually have the right membership, you could set one up with most high street financial institutions, strengthening communities, credit unions or perhaps the post office.