A debtor needs one as a consequence of its bank card supplier or a bank that offers this specific service to find a cash loan

Cash advance bring high independence in the utilization, because they’re without difficulty obtained and employed for almost any urgent costs. The result on the credit is actually negative; regardless if making payments punctually will not improve the borrower’s credit rating, failure to settle contributes to business collection agencies that damages it. This new fines of the pay day loan is significant, close raised rates and you can fines to possess put off money or inadequate cash. This new repayment agenda can be strict, demanding the latest borrower to repay the loan on the second pay-day completely. They poses a risk if the borrower’s economy has not enhanced by then.

10. Payday loans

Payday loans is actually quick-name money provided with loan providers or via playing cards, making it possible for borrowers immediate access so you can finance. He’s strongly related unsecured loans because they offer a fast funding solution, regardless if usually at the high interest rates and faster repayment symptoms than just antique unsecured loans. Borrowing is specially useful for level urgent bucks demands however, influences good borrower’s credit score negatively if you don’t treated very carefully.

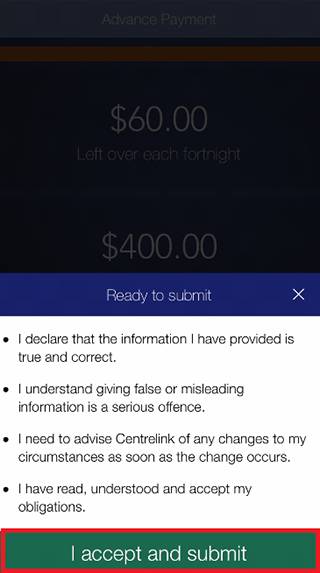

The procedure concerns guaranteeing the fresh borrower’s credit limit having accessibility, held from the an automatic teller machine or courtesy a bank transaction. Variable rates of interest all are which have payday loans, definition the eye fluctuates according to the financing market.

Payday loans become a shorter financing title and a loan amount limited to the borrower’s credit line. Self-reliance in the need is an option element, given that finance can be used for different instant expenses rather than constraints imposed of the financial. The flexibility comes with tall fines for later costs, and this drastically increase the cost of credit.

Fees dates for the money improves are usually strict, with high standard to possess timely payments. Incapacity to stick to the fresh repayment agenda causes large punishment and additional problems for the brand new borrower’s credit history. Cash advances render quick finance, but their terms and conditions and you may prospective impact on economic wellness need to be cautiously thought before taking away that.

- Autonomy and Independence: Personal loans can be used for numerous motives, in the place of auto loans otherwise mortgage brokers, which must be used having certain motives. Borrowers fool around with signature loans for debt consolidation reduction, family home improvements, medical emergencies, weddings, and a loan with no income you will take a trip.

- Unsecured Nature: Personal loans do not require security, and therefore the latest debtor does not have any in order to vow assets including a home or car against the mortgage. It pros individuals who do not individual tall possessions or choose to not chance the property.

- Easier Degree Standards: Signature loans normally have less stringent degree standards, instance out of fico scores, versus other types of investment. Loan providers give unsecured loans according to monetary health and money balances rather than fico scores.

- Repaired Rates of interest and Payments: Most personal loans come with repaired interest rates and you may monthly obligations which do not change over the life of your loan. New predictability makes it much simpler to help you funds and you can plan financial expenses.

- Fast Capital: Loan providers procedure signature loans quickly. Certain loan providers give loan approval and you will disbursement within this times of an application, such as useful for immediate monetary need.

- Debt consolidating: Signature loans are commonly used for merging financial obligation. Borrowers cure their attention rates and just its money into the you to definitely payment if you are paying of numerous costs with an individual private financing.

- Credit score Update: Taking out fully an unsecured loan and you can while making regular on the-time repayments assist in improving a credit history. They demonstrates to credit reporting agencies your borrower is capable of managing and you will paying personal debt responsibly.