FHA finance are for sale to unmarried loved ones and you can multifamily home. This type of home loans enable it to be banking institutions to continuously issue financing with very little chance or capital conditions. The fresh FHA cannot topic money otherwise set interest rates, it guarantees up against standard.

FHA finance enable it to be individuals who may not qualify for a traditional home loan get a loan, especially first time home buyers. These funds offer low minimal off repayments, sensible borrowing from the bank standards, and flexible money conditions.

What is actually an FHA Loan?

During the 1934, brand new Government Homes Management (FHA) are centered to change casing criteria and to render a sufficient home financing system having mortgage insurance policies. Today parents that can has actually or even started omitted from the construction home.

FHA does not build lenders, it guarantees financing; is an excellent homebuyer default, the financial institution was reduced regarding the insurance coverage fund.

- Get property which have only step 3.5% off.

- Perfect for the initial-day homebuyers incapable of build huge off costs.

- Suitable mortgage solution for those who will most likely not be eligible for a conventional financing.

- Down-payment recommendations software would be put in an excellent FHA Mortgage for additional advance payment and you may/otherwise closing benefit.

Documents Necessary for FHA Funds

Your loan recognition depends 100% on the documents you offer during the time of software. Make an effort to render right information about:

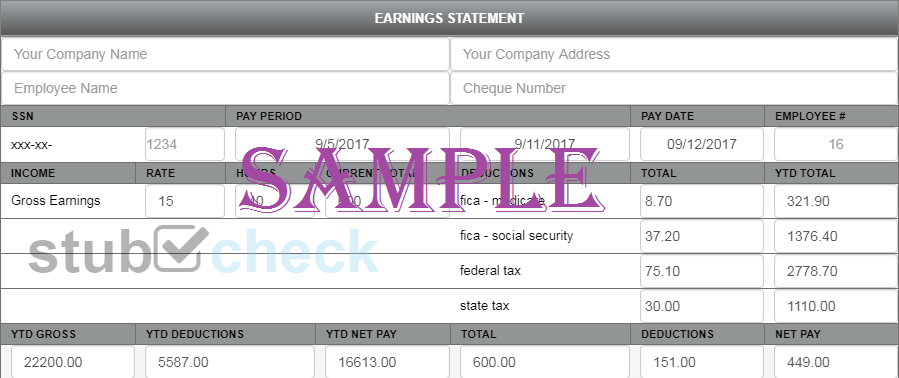

- Complete Taxation Output to have previous 2-years

- W-dos & 1099 Statements getting earlier 2-many years

- Pay-View Stubs for earlier in the day 2-days

- Self-Working Taxation Returns and you may YTD Cash & Losings Statements having previous step 3-decades to have worry about-working individuals

- Over bank statements for everyone is the reason past 3-months

FHA In place of Conventional Loans

The main difference in an effective FHA Mortgage and you can a conventional Family Mortgage is the fact a great FHA loan need a reduced down-payment, in addition to credit qualifying conditions having a borrower isn’t as tight. This allows those individuals instead of a credit score, otherwise having small borrowing issues to get property. FHA needs a fair reasons of any derogatory activities, however, use a wise practice borrowing underwriting. Some consumers, having extenuating issues nearby personal bankruptcy released step 3-in years past, could work to prior borrowing from the bank difficulties. Although not, antique financing is dependent greatly abreast of credit reporting, a get offered by a cards agency for example Experian, Trans-Union otherwise Equifax. When your score was underneath the minimal standard, you may not meet the requirements.

Exactly what do I Manage?

Your monthly will cost you ought not to meet or exceed 31% of the disgusting month-to-month earnings having an effective FHA Loan. Total houses will cost you tend to lumped together is actually referred to as PITI.

Your own full month-to-month will set you back, or financial obligation so you’re able to money (DTI) adding PITI and you may a lot of time-identity debt for example auto loans or playing cards, shouldn’t meet or exceed 41% of terrible month-to-month income.

Monthly Earnings x .41 = Restrict Complete Month-to-month Will set you back $step three,000 x installment loans for bad credit online Vermont.41 = $1230 $1,230 complete – $870 PITI = $360 Greeting getting Monthly Long lasting Personal debt

Personal bankruptcy and you can FHA Financing

Sure, essentially a bankruptcy wouldn’t prevent a borrower regarding obtaining a great FHA Mortgage. Essentially, a debtor must have re-built their credit of at least a couple borrowing membership eg once the a car loan, otherwise credit card. Following wait 2 years since launch of a part seven case of bankruptcy, otherwise has no less than one year off installment to own a good Part 13 (new borrower have to find the fresh consent of your own process of law). And, the new debtor should not have credit points instance later repayments, stuff, otherwise borrowing from the bank charge-offs since the bankruptcy. Unique conditions can be made if a debtor enjoys sustained using extenuating items particularly thriving a critical health issue, together with so you’re able to declare themselves bankrupt given that highest medical expenses decided not to be distributed.

Rating an instant Offer

By giving their contact number and you can/or current email address your agree to located position, has the benefit of, or any other marketing and you can marketing and sales communications off Slogan Financial Happier Valley . This may become calls otherwise text messages taken to your mobile device via an automatic cell dialing program for folks who elect to bring your own phone number to us because the a question of contact. Please note: Practical investigation and you may chatting prices could possibly get implement. Of the pressing Send you agree to these connectivity and to our very own Terms of Provider and you may Online privacy policy