Which have home values carried on to increase, homeowners features attained way more security nowadays. This could allow you to re-finance your house and clean out current monthly financial insurance fees. It’s also possible to fool around with you to equity to repay large attract personal credit card debt or utilize the cash having domestic fixes.

Property owners take advantage of the benefits of committing to their house season just after year. For the majority, truth be told there happens a time when one funding can come in useful. Refinancing that have an FHA mortgage can prove to be a beneficial treatment for place you to security to the office. Just remember that , FHA refinancing is offered to homeowners that happen to be currently through its house as his or her prominent residence today.

FHA Dollars-Out Re-finance

So it refinancing option is specifically great for homeowners whoever possessions features enhanced in market price while the domestic was ordered. A profit-Away Re-finance lets people to help you refinance the established home loan by using out an alternate financial for over it currently owe. Becoming entitled to an FHA dollars-aside refinance, individuals will require at the least 20% security on the property based on a separate assessment.

A cash-Out Refinance might be a sensible choice for of numerous property owners. Whether it’s having home improvement, educational costs, debt consolidating (to repay almost every other higher rate of interest loans), education loan personal debt, or domestic renovations, you can access currency you have within the an enthusiastic illiquid resource.

- Credit score GuidelinesApplicants must have the very least credit rating out-of 580 so you’re able to be eligible for a keen FHA bucks-out re-finance.

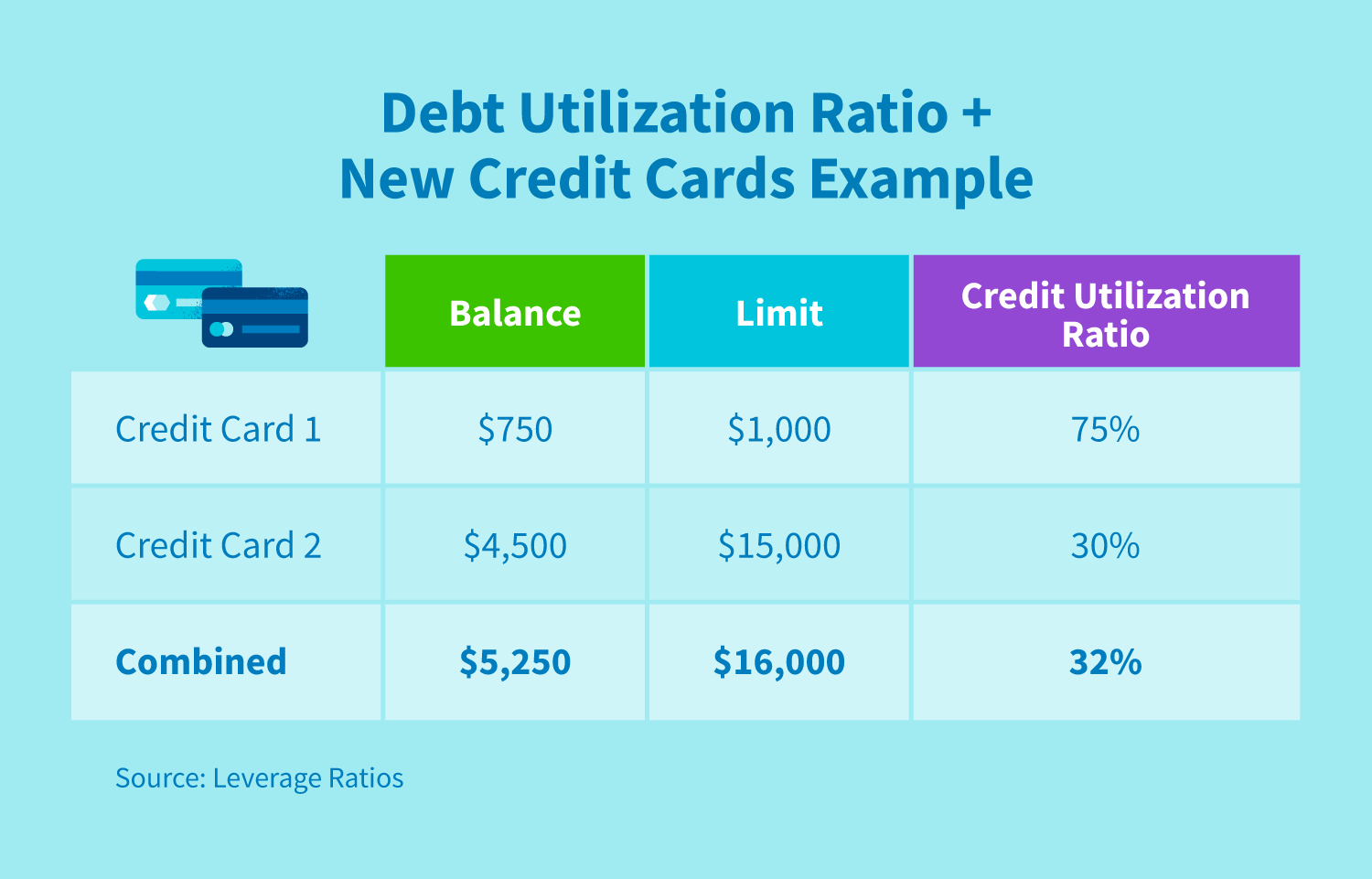

- Debt-to-Income Ratio GuidelinesThe FHA enjoys guidance from a keen applicant’s personal debt-to-money ratio to help keep payday loan Moffat individuals from stepping into home loan plans that they cannot afford.

- Limitation Financing-to-Worthy of GuidelinesFHA Bucks-Out Re-finance financing has a maximum mortgage-to-property value 80 per cent of the home’s latest worthy of.

- Fee Records RequirementsDocumentation is required to prove the debtor provides made all of the monthly obligations to your previous 1 year.

- Willing to Apply for a keen FHA Dollars-Aside Refinance loan?

- FHA Refinance Bucks-Away compared to. Rate of interest Cures

- FHA Home loan Rescue: Do you need Dollars-Out Refinancing?

FHA Streamline Refinance

This refinancing option is experienced streamlined as it enables you to reduce the interest rate in your current financial quickly and you may more often than not rather than an appraisal. FHA Improve Re-finance in addition to significantly reduces the degree of papers that really must be done by your bank saving you valued time and cash.

- Your current Home loan Need certainly to Currently End up being FHA-InsuredWhile refinancing away from a normal financing to 1 backed by brand new FHA is possible, the Streamline option is only available to consumers with a current FHA financing.

- The loan Should be CurrentThis means you haven’t missed one repayments. You must have made about 6 monthly premiums and get got your financial to have at least 210 days prior to you can apply for the latest Streamline Re-finance solution.

FHA Effortless Refinance

This new FHA Easy Re-finance allows property owners to go off their newest FHA Loan towards yet another you to definitely, be it a fixed-rate loan otherwise an arm. So it refinance is considered the most straightforward, and there is no selection for bucks-aside. Loan providers will need a cards degree, earnings, and you will property to guarantee the borrower match the borrowed funds criteria.

People should consider numerous circumstances while deciding some great benefits of refinancing their mortgage loans. Here are several of the most well-known requires consumers have when progressing using their re-finance solutions.

FHA Treatment Mortgages

Of numerous buyers decide to buy a property which is rather earlier, rather than in the most readily useful standing. The fresh FHA 203(k) Rehabilitation Loan allows individuals to invest in the acquisition otherwise refinance from a home, along with its recovery otherwise “rehabilitation” of the home. HUD lets Point 203(k) financial support for use for:

FHA Reverse Mortgage loans

An enthusiastic FHA opposite mortgage is perfect for home owners age 62 and you can more mature. It permits the fresh new borrower to alter collateral at home into the income otherwise a line of credit. The brand new FHA opposite home mortgage is even known as property Security Conversion process Home loan (HECM), which can be paid down in the event that homeowner don’t takes up the possessions.