Criminal background checks on the some body making an application for a keen FHA otherwise USDA financing usually gauge the man or woman’s credit history and you may credit score, verify the individuals latest a job condition, and you may guarantee the individuals term

- Taxation variations for the past 2 years

USDA financing qualifications claim that no cash is required just like the good advance payment buying a property. This is the simply system in the U.S. which provides zero-off mortgages for those that commonly army veterans.

Background checks towards some one trying to get a keen FHA or USDA mortgage have a tendency to gauge the person’s credit score and you will credit score, make sure the individuals most recent a position condition, and you can verify the individual’s identity

- Proof of a career over the past 2 yrs

- Credit rating with a minimum of 620

- Don’t possess stated bankruptcy prior to now 3 years

- Cannot be outstanding to the one federal loans, also restitution

- Background check

Criminal record checks into individuals trying to get an enthusiastic FHA or USDA financing tend to gauge the individuals credit score and you may credit score, be sure the individuals latest a job reputation, and you can guarantee the individual’s term

- Names and details of all companies in addition to shell out stubs to your early in the day few days

- Breakup decree otherwise youngster service arrangement in the event the paying otherwise researching child help

- Tax variations for the past 2 years

- House statement over the past times

Extremely lenders do not perform criminal background checks towards financial individuals. However, they will certainly get their credit history, verify the income, and make sure their residency over the past ten years.

When purchasing property, this type of loans are great for felons whom will you should never are able to afford so you can qualify for a home loan thanks to old-fashioned mortgage programs. This typically occurs of staying in jail with no work, having no money for a time, being incapable of make ends meet.

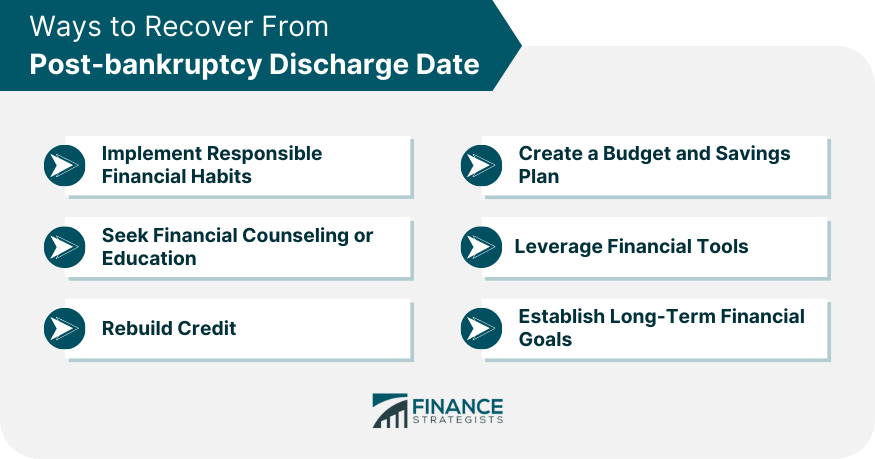

Family at your home tend to strive financially while you are felons try incarcerated, and you may expense mount up. It appear to causes filing for bankruptcy proceeding and you may monetary imbalance when felons have finished the sentence.

They are able to as well as work with strengthening its credit score and you may have indicated their need to live an honest existence from the going through good re-entryway program or bringing after that degree and studies to find the degree and you will experience they have to select work

Its credit history is commonly quite low down to these battles. Felons often have an unstable really works history also. It haven’t kept a career inside neighborhood because they was in fact sentenced in order to prison. Having felons in cases like this, FHA otherwise USDA finance are a great way to get a home.

FHA and you can USDA funds also offer competitive rates, one align that have business-styles. Which have USDA financing, we recommend to order within the rural elements. New USDA loan is an outlying homes loan which provides the brand new benefit of not demanding a down-payment rather than having good limit home cost.

However, you will need to note that so it financing, available with a federal government agencies, does have specific property requirements that mandate your house is situated in an outlying area. While doing so, discover money constraints on the visitors, and you can home loan insurance policy is needed for the whole financing title.

Felons must take the purpose undoubtedly and become chronic. It will not be easy to pick possessions. Carrying out the things that it will require to-arrive you to objective and purchase a home would-be problematic, but what wasn’t since making jail?

The main thing for felons to not lay on the a home loan application. Including giving not true information, omitting earlier in the day work, fabricating prior employers, and it’s also dishonest about their criminal record. Sleeping regarding a felony on the a mortgage software constitutes swindle, punishable from the you’ll prison time.

Felons must be happy to perform what must be done. They may have to reside in a flat or any other small-identity houses in the beginning up to they are able to get america cash loans Blue Springs on their own in a posture to be able to buy property.