Taking a look at the fresh Dining table

As found throughout the dining table, brand new advance payment fee significantly impacts the brand new monthly mortgage payment. Having a reduced 5% off, this new fee is about $3,160 a month. But with a huge 30% advance payment, the brand new monthly pricing decreases drastically to over $dos,328.

A unique main factor that’ll changes which dating is the mortgage interest. When the rates rise, the new monthly payment per circumstance manage raise. On the other hand, if rates go lower, money commonly fall off.

Should you want to purchase an effective $five-hundred,000 house, however your money is not that highest, then you will have to have a giant down-payment. Higher down money be much more preferred to possess 2nd otherwise 3rd-go out homeowners.

Simply how much Is step one% Down Focus Rescue?

Rates will always changing. Since the industry changes and you can cost start to get rid of, its useful to think just how much a reduction in interest make a difference the payment.

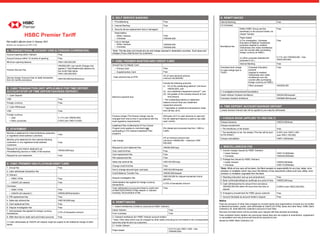

The following is an assessment dining table exhibiting the fresh new monthly payments to possess an effective $eight hundred,000 loan from the payday loan cash advance Sylacauga other interest levels more a 30-season months:

This desk depicts exactly how your advance payment matter, in conjunction with your own rate of interest, has the biggest impact on the month-to-month will cost you as well as how far you could potentially qualify for.

When examining just how much earnings you really need to manage an excellent $five-hundred,000 house, you will want to earliest find out an estimated advance payment and rate of interest.

Additional Costs to adopt

Homeownership has additional can cost you at the top of a month-to-month mortgage percentage you to grounds with the housing value. Homeowners and their mortgage agents also need to believe property taxation, home insurance, repair costs, tools, and other prospective unforeseen expenses.

Property Taxation and you may Homeowners insurance

It’s easy to notice solely on financial matter whenever budgeting to possess property. But never neglect property fees and you can insurance costs.

Assets taxation rates assortment by county; towards the mediocre You.S. general, the newest active possessions tax price are 1.10% of one’s residence’s reviewed worthy of. However, of many states, instance Tx, have higher property tax costs. Be sure to funds accurately on the assets taxes of household you purchase.

Homeowners insurance rates confidence facts like the area and you may many years of the home. Research rates to guess this type of can cost you since costs will vary by the vendor. Remember that portion susceptible to flooding or wildfires may wanted a lot more insurance policies.

Repairs or other Costs

The costs from homeownership usually do not avoid once you have purchased a property. Even after moving in, home include bills to invest and repair needs that need cost management. Whether you’re believe a remodelling or perhaps not, it’s imperative to arranged funds having maintenance.

It is suggested so you can budget as much as 1% from an excellent home’s full well worth annually to have restoration and to have elderly properties. Meaning when you find yourself to find an effective $500k house, you need to kepted at the least $5,000 annually having fix and you will unexpected expenditures.

Since the financial gets your right in front home, sensible budgeting for your extra will cost you off possession is actually an enthusiastic crucial part of getting a happy resident. Your realtor will help review the full photo.

And make a good $500k Home Sensible

To purchase good $five-hundred,000 house is a major investment decision. Very, just what income do you need to comfortably afford a house into the which spending budget?

Just like the a guideline, you ought to invest no more than 28% of gross month-to-month income to your homes and no over 36% on loans upkeep. This means that whilst you can also be be eligible for that loan which have up to good 43% DTI, it isn’t necessary.

In the modern climate, the money expected to get a beneficial $500,000 domestic varies considering personal earnings, advance payment amount, and interest rate. not, and when a market price out-of eight% and you can an excellent 10% down payment, your loved ones income would have to end up being regarding the $128,000 to cover a great $five hundred,000 domestic. Yet not, money needed transform in line with the advance payment and you can focus rates.