Whether you are shopping for very first home, forever house or even a vacation home, there is just the right mortgage unit for you.*

- Particular Funding Software

- Competitive Pricing

- Refinancing Available

- Private Services

- Well reasonable changeable and fixed costs

- Few terms available

- Pre-approval available

- Zero pre-percentage punishment

- Refinance to possess a potentially most readily useful rates

Willing to Implement?

So it financial is made to meet the requirements of the earliest-date house buyer. It has restricted aside-of-wallet will set you back (prepaid service things). It has zero origination fees, no closing costs, zero personal mortgage insurance rates (PMI), zero down-payment standards with no prepayment charges. It has an aggressive speed that’s offered once the a thirty-12 months repaired price or a 5/5 Sleeve. In order to meet the requirements just like the an initial-time house client, the new applicant don’t has had a property otherwise got a possession need for a primary residence for the past 36 months.

When you yourself have got mutual possession for the a property throughout the history three years, you could potentially incorporate just like the one candidate and qualify for the new first-day mortgage.

We have built a primary-Go out Homebuyers Book. This will help to walk you through the house-purchasing techniques and that means you understand what to anticipate and can getting wishing.

Affordable Option Mortgage

Basic Area offers a 5-season Variable Price Mortgage (ARM) that give less initial payment and you will slowly adjusts more date. The initial rate remains the exact same into the earliest 5 years, therefore dont to improve more than 2% at every variations and no more six% along the lifetime of the borrowed funds. Jumbo mortgage amounts are available plus a seven-year Arm. For all Arm finance, merely 10% down must prevent Private Home loan Insurance coverage (PMI).

Fixed-Speed Mortgages

The fresh new repaired-price financial has got the security regarding a predetermined interest to possess the whole lifetime of the loan. Very first Society offers 10, 15, 20 and you will 29-12 months repaired mortgages. We advice it mortgage if you plan in which to stay your own domestic for more than 10 years and require the security out of mortgage repayments that won’t transform.

Travel Home loans

Thinking about a home on the run? Buying your own trips family makes you escape due to the fact often as you like! There’s unlimited potential for a house right on the fresh lake, about slopes, beach or something like that set off of the defeated highway. We can help to make it a reality that have home financing. Which have many loan circumstances readily available, reduced costs and competitive cost there may never be a far greater go out!

Homes Finance

Earliest Area commonly loans https://paydayloancolorado.net/maysville/ the purchase out of property or refinance a great land loan whether you wish to build a house or just invest. Most of the unused land money is actually amortized more than 15 years and 2, 3 or 5-year balloon house financing come.

Jumbo Loans

If you wish to obtain at the least $766,five hundred it is sensed a great jumbo mortgage. We have varying and you can repaired rates for the jumbo mortgage loans. Not everyone now offers jumbo mortgages and you may all of our cost are always competitive.

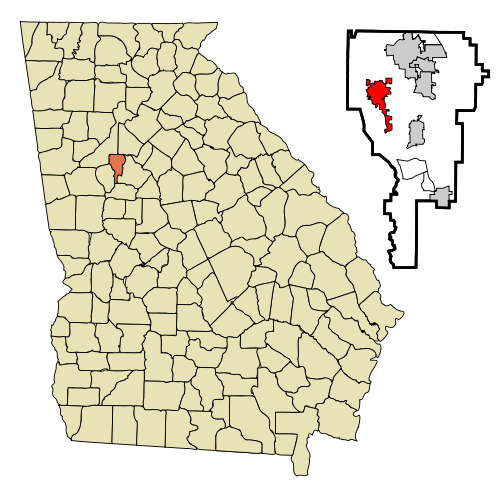

$step 1 display deposit expected. Need to top quality to have registration. Loan subject to credit acceptance. Prices, fine print was at the mercy of alter without warning. Escrow account requisite. Home insurance, home fees and you can interim interest should be pre-reduced from the closing. Very first Area Credit Partnership NMLS ID # 684198. Federally insured by NCUA. Equal Housing Financial. Functions have to be owner-filled otherwise a holiday residence. Limited inside the Missouri, Illinois, Tx, Ohio, Arkansas, Tennessee, New york, South carolina, Georgia, Alabama and Florida. Called for LTV may vary because of the state.

step 1 Very first-big date homebuyers is actually recognized as men and women individuals who’ve perhaps not owned a house otherwise had a control interest in an initial home over the past three years.

Just remember that , their annual real estate taxes was repaid individually by Very first Neighborhood with the financing on the escrow account. To own concerns contact Financing Maintenance.

Scarcity Information Mode

If you have a shortage on your escrow account fully for your mortgage, you’ll be able to transfer money from the first Neighborhood account to your escrow. The dearth count is actually listed on your own Escrow Declaration. The brand new Escrow Comments are sent aside on a yearly basis inside late January. By using Elizabeth-Comments, you’ll find they within this On the internet Banking. If you do not need to send on your Shortage Guidance Means or take it into regional department, you might use the brand new electronic Lack Recommendations Setting into the our web site.

Very first Community knows that domestic-to purchase try a large milestone in daily life, and now we is here in order to reach your requires. We’re ready to extend the financial device accessibility as a consequence of our lovers to start with Tradition. This partnership was made in order to give our very own membership a selection for applying for a 30-seasons repaired FHA otherwise Va mortgage.

A national Housing Management (FHA) loan was a home loan that is covered and guaranteed of the government. FHA mortgages was fixed-speed money that have a 30-season title.

An enthusiastic FHA mortgage tends to be an excellent option when your credit rating might have been a barrier or if less advance payment was a much better complement your allowance. As a result of the all the way down credit rating and you may deposit criteria, FHA fund are specifically appealing to first-date homeowners. FHA fund enable it to be anyone up against economic challenges to invest in a property and begin strengthening equity in the course of time.

The fresh Virtual assistant financing system offers a form of authorities-recognized real estate loan so you can certified newest and you will former military players and you may qualified partners.

No Deposit: Unlike really mortgages, eligible borrowers normally obtain around a full cost out-of our home, so that they don’t have to care about putting aside money for a down-payment.

No Individual Home loan Insurance coverage (PMI): That have traditional mortgage loans, you will need to pick PMI unless you has actually a downpayment of at least 20% of your own house’s cost. Virtual assistant financing do not require personal home loan insurance.

Fewer Closing costs: After you buy a property having a normal mortgage, you certainly will shell out thousands of dollars in conclusion can cost you before you could obtain the secrets to your house. With a great Virtual assistant loan, possible pay fewer settlement costs, because Institution of Pros Activities constraints what lenders may charge you. (Although not, bear in mind that many Va loans manage have a beneficial high initial financial support commission, but this will be rolled to the mortgage.)

Take note, First Society features married that have Earliest Tradition and also the app often getting underwritten, canned and you may serviced from the Earliest Community. It’s also possible to use toward the webpages from the pressing “Apply Now” ahead or bottom on the webpage. When you yourself have questions, you can even contact Basic Culture at the (800) 808-2662.